🌐 Around the web3 WORLD

💣 The FTX Collapse, 🔐 Proof of Reserves, and more...

🌐 Around the web3

WORLD

💣 The FTX Collapse

🔐 Proof of Reserves

💰 Coins of the week

📰 Top Reads

🙏🏻 Grateful for…

🌐 Around the web3 WORLD

Despite Thursday’s CPI data indicating a slowing YoY inflation rate, the top 3 expenses (Housing, Transportation, and Food) for Americans rose in the month of October, compared to September.

October headline CPI coming in lower than expected, we should expect the Federal Reserve to lower the rate of the interest rate increase.

The collapse of FTX has led to mass liquidations in the Bitcoin futures market.

Smaller entities have bought the dip at a record-level pace.

BTC has been withdrawn from exchanges in droves; a continuation of the trend from the past 2 years.

The 2022 midterms elections results:

- House of Representatives Results: 19 races remain to decide control

-Democrats will keep control of the Senate, CNN projects

House and Senate form the legislative branch of government. They interact with the executive and judicial branches to implement the checks and balances that keep all three branches functioning and prevent any single branch from abusing its power.

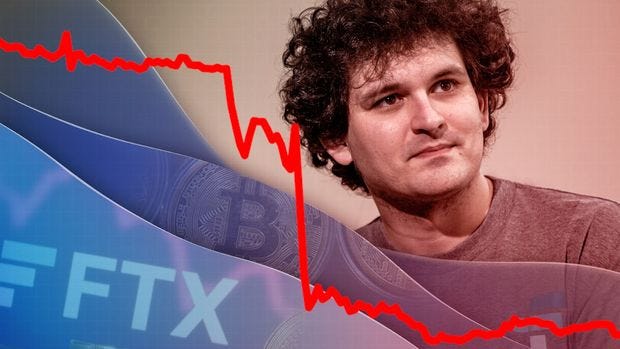

💣 The FTX Collapse

In just nine days, SBF’s crypto empire collapsed. On November 2, Coindesk published leaked balance sheet information that revealed Alameda’s significant exposure to illiquid assets––including ~$5 billion in FTX’s native exchange token FTT––against ~$8 billion in liabilities. Curiously, Alameda’s purported exposure to FTT was larger than its circulating supply. It quickly became clear that FTX and Alameda were more closely tied than the public knew.

FTX competitor Binance announced that it was liquidating FTT, a sizable position from a venture investment in FTX that it had exited the prior year. Thus began the run on the bank. As FTX collapsed and after a few backs and forths, CZ announced his interest in buying FTX to avoid it from going bankrupt but retreated this offer hours later leading to the demise of FTX.

This damaging event has reverberated throughout the crypto world. Its damage is barely starting to surface since FTX was financially involved with several centralized exchanges and exposed to many blockchain protocols including BlockFi, Solana, Skybridge Capital, Yuga Labs, Voyager, and a host of others on a list here..

Why is this important: More than $50 billion has been lost by investors and users. Sam Bankman-Fried, head of FTX, was playing casino games with investors’ money and thought that was going to be able to get away with it. Unfortunately, these tragic events caused by revered leaders in the industry continue to happen and they create havoc in an industry where transparency and democracy are supposed to be the pillars. Now more regulation is expected, hope and trust in the crypto industry have been lost, and those that are financially unaffected are taking their money out of crypto or canceling investing plans.

🔐 Proof of Reserves

The FTX demise as well as Terra/ Luna ecosystem’s collapse and the subsequent insolvencies of Celsius and Three Arrows Capital have brought to the frontline a protocol that will allegedly restore faith in the crypto system.

The major crypto exchange Binance has revealed details about its reserves as nervousness started to spread in the crypto community following the collapse of rival exchange FTX.

According to the information Binance has revealed so far, the exchange held the following digital assets as of November 10: