CEOs Want AI, But Don't Use It Themselves

Plus: China Races Ahead in Driverless Cars

Here’s what we’re tracking today, Team: Where is AI cutting jobs first, and which industries are feeling it most? How could this affect you? At the same time, CEOs are pushing AI across their companies, but many still aren’t using it themselves. And in the global race for driverless cars, China is pulling far ahead of the world. Let’s dive in—and stay curious.

Where AI Job Cuts Are Happening First

CEOs Want AI, But Don’t Use It Themselves

AI Tools - OpusClip

China Races Ahead in Driverless Cars

📰 AI News and Trends

OpenAI to release a friendlier version of GPT-5 with subtle changes after users complained that the model felt too formal

Claude Opus 4 and 4.1 can now end conversations in extreme cases of persistently harmful or abusive user interactions

OpenAI Staffers to Sell $6 Billion in Stock to SoftBank and Other Investors

Sen. Josh Hawley (R-MO) announced a probe into Meta after leaked documents showed its AI chatbots were allowed to have “romantic” and “sensual” chats with children

Your kids (or your) Stuffed Animals will also be AI Chatbots.

🌐 Other Tech news

Meta plans fourth restructuring of AI efforts in six months

Donald Trump is considering new tariffs of 200 to 300 percent on semiconductors

A Falcon 9 rocket launched 24 Starlink satellites on Aug. 14 from Vandenberg, raising the active constellation to over 8,100.

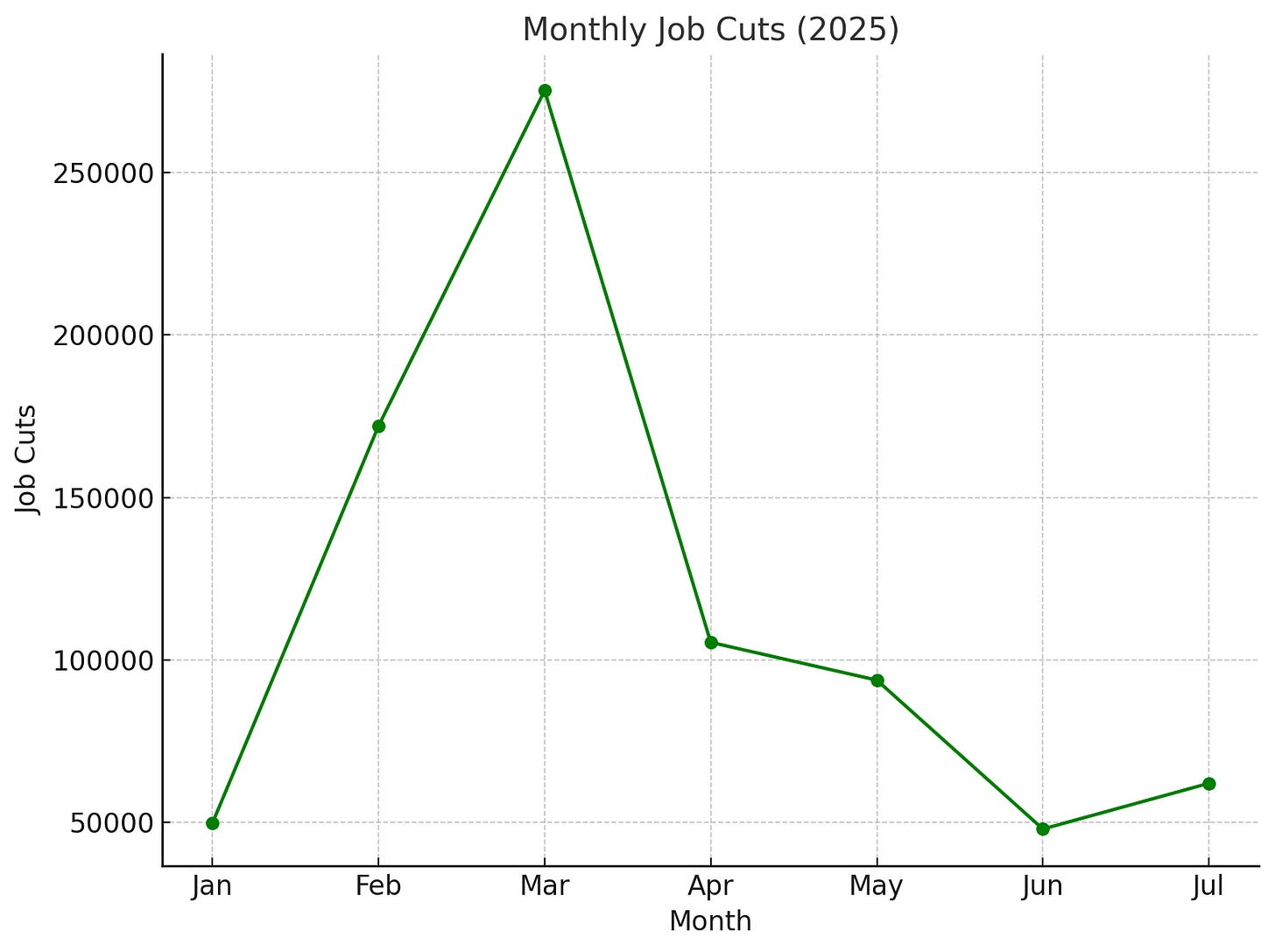

Where AI Job Cuts Are Happening First

AI isn’t replacing U.S. workers en masse—yet. According to MIT’s State of AI in Business 2025 report, the first disruption is hitting outsourced and offshore jobs, not internal staff.

Short vs. long term: Only ~3% of jobs could be replaced by AI in the near term, but nearly 27% are at long-term risk (MIT Media Lab).

Who’s hit first: Business process outsourcing (BPO) and external agencies, companies are cutting vendor contracts instead of laying off full-time employees.

Cost savings: One company saved $8M a year by replacing BPO contracts with an $8K AI tool. Across firms studied, AI cut $2M–$10M annually in outsourcing costs.

Industries most impacted now: Tech and media, where over 80% of executives expect reduced hiring in the next two years.

AI budgets: 50% of AI spend currently goes to sales and marketing tools, even though back-office automations deliver higher ROI.

But:

95% of companies investing in generative AI report zero measurable ROI so far.

Yet firms are still seeing productivity boosts suggesting AI could be a “Goldilocks scenario” higher earnings without mass layoffs.

AI’s first casualties are offshore contractors, not white-collar U.S. workers—but the long-term disruption could hit nearly one-third of jobs.

CEOs Want AI, But Don’t Use It Themselves

Many CEOs hail AI as transformative, comparing it to the internet or the Industrial Revolution. Yet while 77% of executives say AI will reshape business, fewer than half believe their tech leaders are ready, according to a Gartner survey of 456 CEOs.

Younger employees are experimenting with AI daily (spreadsheets, design, marketing), while senior leaders, bogged down in meaningless meetings, often remain hands-off. How are these companies trying to fix this?

Mammoth Brands invites junior staff to leadership meetings to demo AI use cases.

StockX CEO Greg Schwartz had senior leaders build websites and videos with AI tools at a retreat.

Headspace CEO Tom Pickett uses ChatGPT and Gemini to research partnerships, saying it helps him test 10× more ideas.

Law firm Mayer Brown’s chairman shares how AI helps him draft contracts.

Still, adoption is uneven. A Bain study found that only 20% of companies are scaling AI, and half lack integration road maps. Leaders’ hesitation often stems from unfamiliarity and resistance. As Sarah Franklin, CEO of Lattice, put it: “Nobody is fully prepared. At best, they have six months of experience. It’s optimism mixed with FOMO.”

🧰 AI Tool

OpusClip - Video clipping tool that automatically transforms long‑form videos into high‑engagement short clips for TikToks, Instagram Reels, or YouTube Shorts.

Download our list of 1000+ Tools for free.

China Races Ahead in Driverless Cars

China is outpacing the U.S. in autonomous vehicles (AVs), driven by strong government support, national infrastructure investments, and consumer acceptance. By 2030, 20% of new cars in China are projected to be fully driverless, with 70% equipped with advanced assisted-driving systems. Already, 5 firms operate 2,300 robotaxis across 30 cities compared to Waymo’s 700 cars in 5 U.S. cities.

China’s edge comes from deep tech integration (Baidu, Huawei, Alibaba, Xiaomi), strong 5G connectivity, looser data-privacy rules enabling faster model training, and consumer trust: 85% of Chinese drivers are comfortable with AVs versus 39% in the U.S. With only 40% of households owning cars (vs. 90% in the U.S.), the biggest value lies in fleets for ride-hailing, logistics, and delivery.

Safety remains a challenge, fatal accidents and regulatory tightening highlight risks, but adoption continues at scale. Regulators aim to resume approvals for higher-level autonomy by 2026, while Chinese AVs are already expanding into Southeast Asia, the Middle East, and Europe.

Additionally, 72% of Chinese adults trust AI overall, compared with just 32% in the U.S., which is a significant difference in terms of adoption.